Taking Cash to Save Money on Credit Card Processing Fees May Be Costing You More Than You Think!

Contactless payments have made transactions fast and convenient. However, the cost of accepting credit card payments is rising, and legislation limits companies’ ability to impose surcharges for these fees. As a result, asking customers to pay with cash has become more common.

But what are the potential drawbacks to this shift?

Many companies don’t take into consideration the hidden costs of accepting cash.

According to the IHL Group, the actual cost of cash as a payment medium is about 4.7% to 15.3%.

These costs include several factors including safe storage, transportation, counting, and handling fees. Businesses must also consider the risk of handling cash, including potential theft or loss.

On the other hand, accepting credit card payments may come with complicated rates and transaction fees, expensive POS equipment and hidden fees but these can often be negotiated or offset by increased sales and customer convenience.

This article will explore the hidden costs of accepting cash as your main payment medium and how it compares to credit card payments.

Spoiler alert: Credit cards can be less expensive if you are diligent about the overall expense and increase your bottom line cost.

Why is this study important?

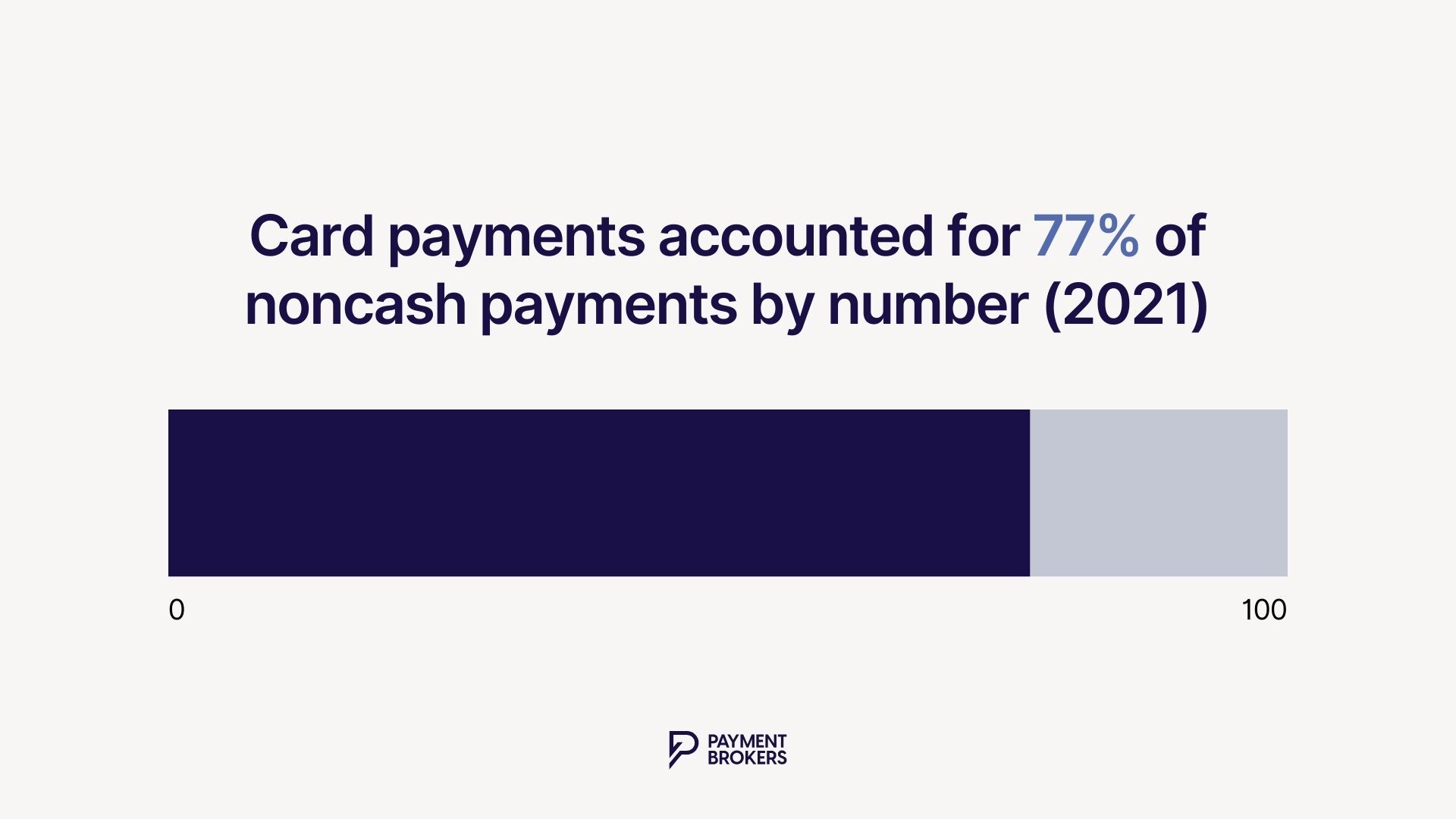

Non-cash payment mediums are increasingly becoming the preferred method of payment for consumers. According to the 2022 Federal Reserve Payments Study, card payments accounted for approximately 77% of non-cash payments by number, growing to 157 billion payments in 2021.

Credit card payments alone reached 51.1 billion transactions. In contrast, ATM cash withdrawals declined to 3.7 billion in 2021.

This indicates a significant preference for card payments over cash transactions.

However, several businesses know very little about this change in consumer behavior, and a good percentage still consider cash their primary payment medium.

Why?

The popular belief that cash is free remains one of the main reasons businesses still prioritize it over credit card payments.

At first glance, it’s easy to understand why cash appears to be the cheaper option. Cash transactions don’t come with transaction fees, and it’s generally assumed that they’re easier to handle and manage.

If you own a small business processing less than $30k in annual revenue, accepting cash may be more cost-effective in the short term.

However, for larger businesses and those looking to grow, the hidden cash costs can quickly add up and eat into profits.

The Costs of Cash Transactions

Let’s break down the cash costs and how quickly they can add up for businesses. (We’ll look at each extensively).

1. Transaction Time

This is a less popular but significant cost of cash transactions. Typically, a cash transaction takes longer than a credit card payment.

According to the small businesses survey conducted by Square, the average time to complete a cash transaction of about $100,000 is 542 hours.

This includes the time it takes to count and handle the cash and any back-end operations, such as reconciling the cash drawer and updating records.

In comparison, a credit card transaction of about $100,000 takes an average of 189 hours, saving businesses over 353 hours for the same transaction.

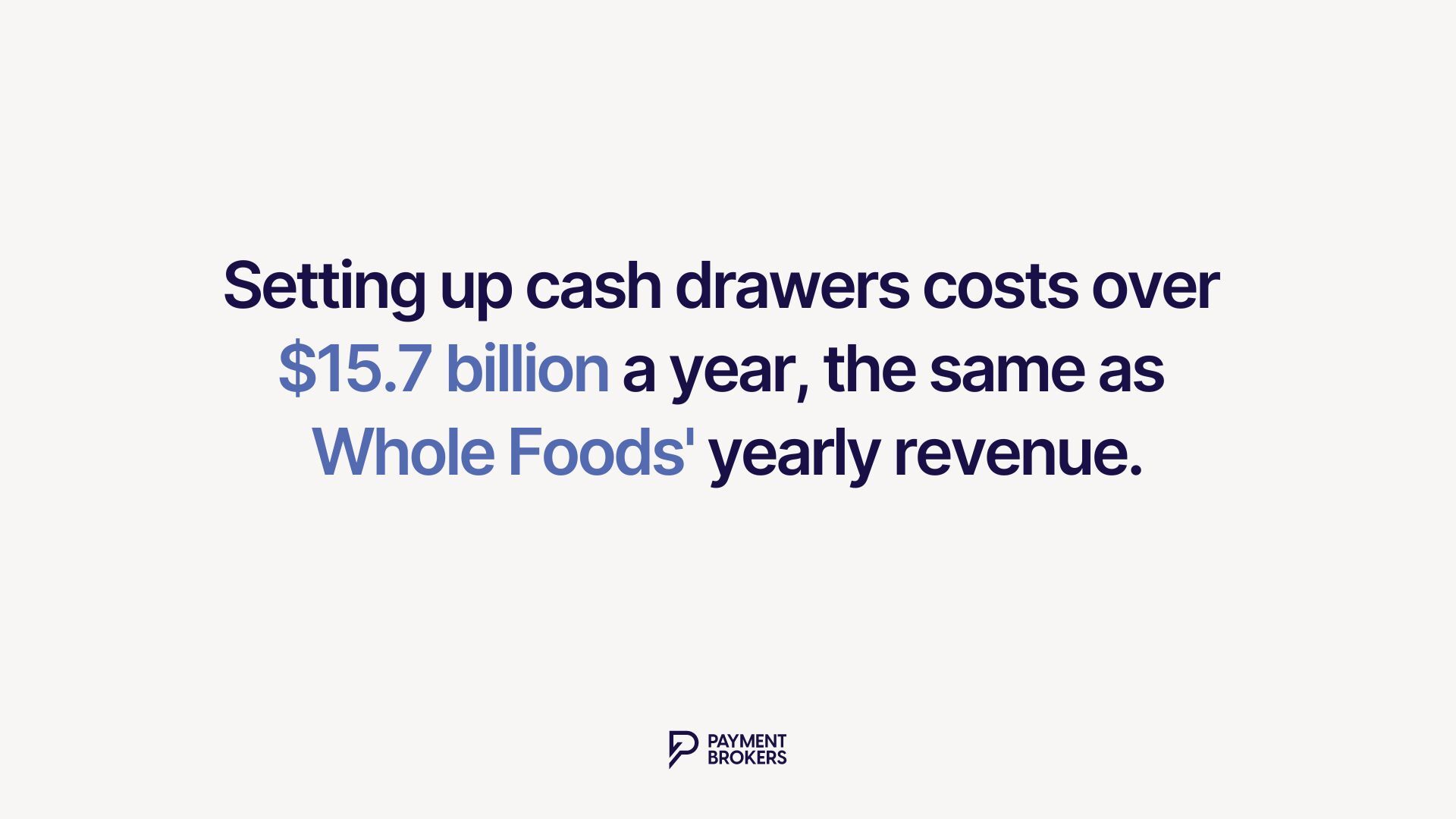

The cumulative time spent counting, retrieving the drawer from the cash office, and setting it in place amounts to over $15.7 billion annually. To put this in perspective, this amount is more than Stripe’s last annual revenue of $14 billion.

2. Storage

When you accept cash, you must have a secure way to store it. You’ll need a safe, cash drawer, and potentially a cash counting machine to keep the cash organized and secure.

A significant challenge most businesses overlook at the initial stage of business is the compounding cost of handling cash. Even if you plan to handle cash yourself, you’ll quickly realize the cost increases as you grow.

Suppose you process $100,000 per year in cash and spend $600 to buy a safe to store the cash. That’s about 0.6% of your annual cash flow.

However, if your business grows and you process $1,000,000 in cash annually, you’ll likely need additional safes, more cash drawers, and potentially hire someone to manage the cash.

3. Counting and Handling Fees

As mentioned earlier, the time it takes to count and handle cash can quickly add up for businesses. This is especially true for brick-and-mortar stores that handle large amounts of bills and quarter coins, which can be time-consuming to count and sort.

Additionally, businesses may need to invest in cash-counting machines or hire someone to handle the cash, which can add up to significant costs.

Overall, businesses spend a staggering $38.5 billion annually on closing out cash drawers.

Approximately 16.3% of this cost arises from the activities of opening and rebuilding the change in cash drawers. This process, which includes the cash office, managers, and cashiers, might take just a minute or two for each activity.

4. Theft and Loss

One of the major risks of handling cash is the potential for theft or loss. Cash is easily stolen or misplaced, and even with proper security measures in place, theft can still occur.

In the unfortunate event of theft or loss, businesses stand to lose the cash and the time and resources invested in counting, handling, and storing it.

For the record, annual employee theft totaled $50 billion, almost as much as businesses spend on cash handling fees annually.

5. Counterfeit Loss

Businesses accepting cash face the risk of receiving counterfeit bills, which they may not be able to detect immediately. This can result in a significant loss, as the business will be unable to deposit the fake currency and will be left with worthless pieces of paper.

According to the Federal Reserve, about $70 – $200 million in counterfeit currency is circulating in the US.

This represents approximately 1 note in counterfeits for every 4000 to 10,000 in genuine currency. Translate that to a business processing $1 million in cash annually; they stand to lose about $70-$200 annually in counterfeit losses.

While this seems relatively small, you need to know that:

- Fake note circulations aren’t evenly distributed across the US. You’re either losing cash a lot, or you’re not losing any.

- As a business, you’ll need to invest further in anti-counterfeit measures such as UV lights, specialized pens, and staff training to detect counterfeit bills.

And while these seem minor, they still contribute to the compounding hidden costs of accepting cash.

6. Security and more

Theft and loss don’t mean these businesses haven’t already invested in security protocols.

Accepting cash requires extra security measures to protect the cash and other assets on-site, even for businesses that have already invested in security protocols.

These measures could include CCTV cameras, alarms, and additional personnel to guard against potential theft.

According to Ackerman Security, the total cost of a business security system can vary widely:

- Security hardware: $1,000 to $10,000

- Installation and activation costs: $300 to $700

- Alarm monitoring: $40 to $120 per month

- Armed, in-store security guards: $25 to $50 per hour

These security measures contribute to the overall cost of accepting cash, adding to the financial burden on businesses.

7. Higher Accounting Costs

Managing cash transactions also results in higher accounting costs for businesses. Unlike credit card payments, which are easily trackable through electronic records, cash transactions require more effort and resources to reconcile and maintain accurate records. This often means more time spent by accountants and higher costs for businesses.

Moreover, the IRS closely monitors businesses that operate primarily with cash and those that report a loss. This increased scrutiny can lead to more frequent audits and the need for meticulous record-keeping, further adding to the accounting burden.

Overall, the costs of cash transactions can add up to a significant amount for businesses, especially as they grow and process a larger volume of transactions.

8. Transportation

The cost of transporting money can be substantial for businesses. Hiring an armored truck pickup can range from $10 to $500 per pickup, depending on the service provider, distance, and location. Additionally, some armored car services may charge extra fees, such as:

- Shipment liability: An additional charge of $0.10 per thousand dollars for shipments valued at or above $150,000.

- On-call rate: An additional charge for on-call pickups instead of scheduled pickups.

These transportation costs can add up significantly, particularly for businesses that handle large volumes of cash regularly. Ensuring the secure transport of cash is essential, but it also contributes to the overall cost burden on the business

The Cost of Credit Card Transactions

The fees associated with credit cards can be complex, and it’s easy for businesses to be intimidated by them.

However, compared to the hidden costs of cash, credit card fees are significantly lower and more transparent.

Interchange fees

Interchange fees can be quite complex and challenging to calculate. There are over 1,000 different rates, fees and interchange categories, and they can vary based on factors such as business type, transaction value, payment card brand, and more.

But that’s not all.

Additional fees are based on how payments are processed—whether they are keyed in, swiped, or processed online. You may also encounter Tier pricing, which imposes surcharges based on whether a transaction is “qualifying” or “non-qualifying.”

It can be quite overwhelming once you get into the details.

Here’s a breakdown of interchange fees for Visa and Mastercard in various regions.

Visa US

The Visa USA Interchange Reimbursement Fees are structured based on various transaction types and card categories. Here is a summary of the key fees:

- Consumer Credit Card Transactions

- Retail: The interchange fee ranges from 1.15% + $0.10 to 2.40% + $0.10, depending on the type of transaction (e.g., card-present or card-not-present).

- eCommerce: Fees vary, with rates like 1.65% + $0.15 for certain types of online transactions.

- Consumer Debit Card Transactions

Interlink: Fees for transactions via the Interlink network generally include a flat fee plus a percentage of the transaction amount. For example, 0.80% + $0.15 per transaction.

- Prepaid Card Transactions

- Retail: Fees are typically around 1.15% + $0.15 to 1.65% + $0.15.

- eCommerce: These transactions also have varied fees, similar to consumer credit cards, but with specific rates for different categories of prepaid cards.

- Commercial Card Transactions

Fees for business, corporate, and purchasing cards generally range from 2.05% + $0.10 to 2.70% + $0.10, depending on the transaction type and card used.

- ATM Transactions

Cash disbursement fees can be flat rates like $0.30 to $1.50, depending on the type of ATM and card used.

These fees are designed to cover the costs of processing transactions and are typically paid by the merchant’s bank to the cardholder’s bank. Merchants often pay a “merchant discount rate” that includes these interchange fees and other processing costs.

For more detailed and specific fee structures, refer to the official document on Visa’s website here.

Mastercard US

- Consumer Credit Card Transactions:

Standard Rate: Generally ranges from 1.58% + $0.10 to 2.95% + $0.10, depending on the transaction type (e.g., card-present, card-not-present).

- Consumer Debit Card Transactions:

Standard Rate: Typically ranges from 0.80% + $0.15 to 1.05% + $0.15.

- Commercial Card Transactions:

Fees range from 1.65% + $0.10 to 2.70% + $0.10.

- Special Programs:

Reduced rates for specific programs like educational institutions, government, and non-profits.

For detailed rates and additional fee categories, refer to the official Mastercard document.

Markup Fees

Markup fees are the fees charged by the payment processor, and they can vary significantly depending on the provider and the payment processing model. These fees include transaction fees, monthly fees, and other miscellaneous fees.

Traditionally, businesses paid a markup fee based on the tier pricing model. Depending on the merchant’s billing history, the provider might charge the lowest or highest rate possible, making it difficult for businesses to predict their fees accurately.

However, businesses have more control over their fees with more transparent and efficient payment processing models such as interchange-plus pricing. They can save significantly in the long run.

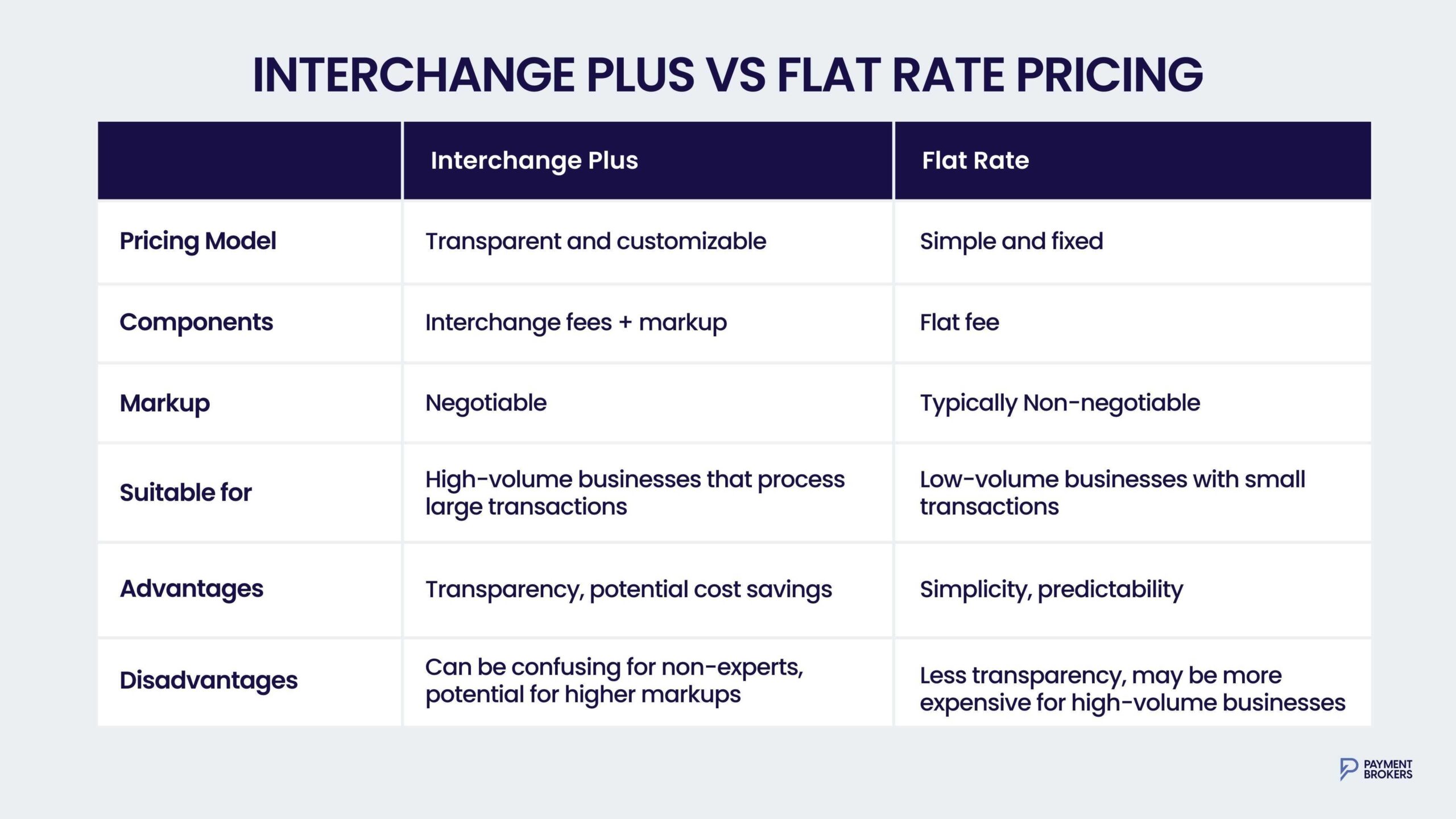

Interchange Plus

Interchange Plus is a credit card pricing method that separates costs into interchange fees set by the card networks and a negotiable markup set by the processing company.

This pricing model is often seen as a more transparent and fair approach to credit card processing fees, as it separates the non-negotiable costs from the markup set by the processing company.

Here’s how the interchange plus pricing model works:

- Interchange fees: Every time a customer uses a credit or debit card, the issuing bank charges a fee (an interchange fee) to the merchant’s bank (the acquiring bank). This fee covers the costs of processing the transaction and is non-negotiable. The interchange fee is typically a percentage of the transaction value plus a flat fee.

- Markup: In addition to the interchange fees, the processing company also sets a markup fee that covers their services. This fee is negotiable and can vary depending on factors such as the processing company, the type of business, and the volume of transactions.

For example, if a customer spends $100 on a credit card transaction, the interchange fee may be 2.5% plus $0.10, amounting to $2.60. The processing company may then add a markup of 0.25% and $0.05, bringing the total cost of the transaction to $2.90.

Interchange plus pricing allows merchants to see how much they pay for each transaction, making it easier to compare processing fees among different providers.

It also means that the merchant’s processing fees will adjust accordingly as interchange fees change.

Interchange Plus vs. Flat rate pricing

A common alternative to interchange plus pricing is flat rate pricing, where merchants are charged a single rate for all transactions, regardless of their type or cost.

This pricing model is often more straightforward and more predictable. Still, it can also be more expensive, especially for businesses that process a high volume of transactions or those with higher-value transactions.

Interchange plus pricing, on the other hand, offers more transparency and potentially lower costs for businesses that process a mix of low and high-value transactions. However, it can also be more complex and require negotiation with the processing company to get the best markup rate.

Advantages of Interchange Plus pricing for businesses

- Transparency: Interchange plus pricing offers a clear breakdown of processing fees, allowing merchants to see exactly how much they pay for each transaction. This transparency can help businesses make more informed decisions about their payment processing.

- Potential cost savings: With interchange plus pricing, merchants can negotiate the markup fee set by the processing company. This can lead to lower costs for businesses, especially those with a high volume of transactions or larger transaction amounts.

- Customizability: Interchange plus pricing allows customization based on a business’s specific needs and transaction volume. As interchange fees change, the markup fee can be adjusted accordingly, leading to a fairer pricing structure for the merchant and the processing company.

- Lower risk: Flat rate pricing can be more expensive for businesses with high chargeback rates, as they are charged the same rate for every transaction. Interchange plus pricing considers the risk associated with different types of transactions, potentially reducing the overall cost for businesses with higher-risk transactions.

Disadvantages of Interchange Plus pricing for businesses

- Complexity: Interchange plus pricing can be more complicated and harder to understand for non-experts compared to the simplicity of flat rate pricing.

- Potential for higher markups: The markup fee in interchange plus pricing is negotiable, which means businesses may end up paying a higher markup if they do not negotiate effectively with the processing company.

In general, interchange plus pricing benefits businesses with a high volume of transactions and larger transaction amounts. However, it is always important for businesses to carefully compare and negotiate credit card processing fees to ensure they are getting the best deal for their specific needs.

Tiered Pricing

Tiered or bundled pricing is the traditional method of pricing credit card transactions. With this model, businesses are charged a different rate for each type of transaction, depending on the tier under which they fall. The tiers are usually determined by the card type, transaction type, and merchant category code (MCC).

For example, a payment processor may charge a qualified rate of 2.5% for swiped transactions and a mid-qualified rate of 3.5% for keyed-in transactions.

The problem with this pricing model is that businesses often have little control over which tier their transactions fall under, and providers may charge the highest possible rate if the business has a high-risk MCC or if the transaction is not swiped.

Flat Rate Pricing

Flat-rate pricing is similar to tiered pricing in that businesses are charged a fixed rate for each transaction. However, unlike tiered pricing, the flat rate is the same for all types of transactions, no matter the card type, transaction type, or MCC.

The downside of this pricing model is that businesses may pay higher fees if they process a high volume of transactions or if their average transaction value is higher. It may be a good option for businesses that process low volumes or if most of their transactions are under $25.

But with good negotiation, you can easily reduce the flat rate to 90% and remove all other fees that add to the expense.

Other hidden fees in credit card processing

Aside from the interchange fees and markup fees, businesses should also be aware of hidden fees that can add up and significantly increase their costs. These can include:

- Regulatory & Compliance Fees

Payment processors charge regulatory and compliance fees like PCI to help cover the costs of complying with the Payment Card Industry Data Security Standard (PCI DSS). These fees can range from $20 – $40 monthly and may be charged regardless of whether the merchant is compliant. However, this is also often used to hide unnecessary fees under the guise of some new regulation.

- Terminal Fees

You may be charged a monthly terminal or equipment fee if you have a physical location and use a card reader or POS system to accept credit card payments. This fee covers the cost of maintaining and providing the equipment for your business and can range from $10 to $50 monthly.

- Chargeback Fee

A chargeback fee is charged when a customer disputes a transaction, and the payment processor is required to refund the funds. These fees can range from $20 – $40 per transaction and quickly add up if your business experiences many chargebacks.

- Annual Fees

Some payment processors may charge an annual fee in addition to monthly, interchange, and markup fees. These fees can range from $50 – $300 per year and quickly be overlooked by businesses.

There are a ton of other hidden fees like batch and settlement fees, gateway fees, security or tokenization fees, monthly service and statement fees to name a few.

While that seems like a lot, it’s all negotiable with the right strategy.

Credit Card vs. Cash: Which is More Effective?

Let’s look at the pros and cons of accepting credit card transactions compared to cash.

Pros of Accepting Credit Card Transactions

- Increased Sales: By accepting credit card payments, businesses can reach a wider audience of customers who prefer using non-cash payment mediums. This can result in increased sales and revenue for businesses.

- Faster Transactions: Credit card transactions are typically much quicker to process than cash transactions, saving businesses valuable time and resources.

- Safer Transactions: Unlike cash, credit card transactions leave a clear electronic trail, making them more secure for businesses and customers.

- Lower Labor Costs: As explained earlier, accepting credit card payments can save businesses significant labor costs compared to handling and managing cash transactions.

Cons of Accepting Credit Card Transactions

- Transaction Fees: Credit card transactions may come with transaction fees, which businesses must factor into overall costs.

- Chargeback Risks: Businesses may face the risk of chargebacks, which can result in additional costs and losses.

Pros of Accepting Cash

- Widely Accepted: In some cases, cash may be the only accepted form of payment. By accepting cash, businesses can ensure they are accessible to all potential customers.

- No Transaction Fees: Cash transactions don’t come with transaction fees, so businesses don’t have to worry about added costs.

- Easy to Manage: Cash transactions are generally assumed to be easier to handle and manage than credit card transactions.

Cons of Accepting Cash:

- Hidden Costs: As we’ve seen in this article, there are hidden costs associated with accepting cash, which can add up and impact businesses’ profits.

- Risk of Theft and Loss: Handling cash comes with the risk of theft, loss, and counterfeit notes, which can result in significant business losses.

- Potentially Slower Transactions: Cash transactions can take longer to process than credit card transactions, resulting in longer customer lines and wait times.

- Limited Record-Keeping: Unlike credit card transactions, cash transactions are not easily trackable, making it more difficult for businesses to keep accurate records and manage their finances.

- Limited Accessibility: With the rise of contactless and mobile payments, cash is becoming increasingly less accessible and convenient for customers who prefer to use cards or digital payments.

- Higher Labor Costs: As explained earlier, managing and handling cash can increase business labor costs.

The Bottom Line

While accepting cash may seem easy and cost-effective, its hidden costs can quickly add up for businesses. In contrast, accepting credit card transactions may come with transaction fees, but they are significantly lower and more transparent than the hidden cash costs.

Cash may still be the most cost-effective option for small businesses (processing less than $30k per year), considering the low volume of cash transactions. However, for larger businesses and those looking to grow, accepting credit card payments may be the better choice in the long run, as it can result in increased sales, faster transactions, and lower labor costs.

Business owners should carefully evaluate their payment processing options and consider negotiating with payment processors to ensure they get the best possible rates and minimize hidden fees.

There are no generic negotiation tactics that work for every business, but Payment Brokers has consistently helped businesses save an average of 28% on their credit card processing fees.

Book a call with us today for a free analysis of your current fees and see how much you can save.