Junk fees are not mere line items on a bill.

They represent a significant expense that can impact both consumer spending and merchant profitability.

A recent study by the Consumer Financial Protection Bureau (CFPB) highlighted that hidden fees cost American consumers billions each year, often buried in the fine print of transaction agreements.

One of these newly targeted “Junk Fees” is credit card surcharges imposed by merchants.

But it’s important to note that businesses are not spared from these expenses.

The Merchants Payments Coalition (MPC) reports that merchants paid over $100.75 billion in credit card processing fees alone in 2023, an increase of $7.5 billion from the previous year.

These fees vary significantly, with small businesses often facing charges as high as 4% per transaction, compared to larger corporations that might negotiate rates as low as 2%.

In this article we will dive into the world of junk fees and, unpacking the layers behind these costs and their economic implications.

We’ll explore how these fees are structured, the legislative environment controlling them, and their broad impact on market behavior—from consumer purchasing decisions to the strategic responses by businesses aiming to mitigate their effects.

Key Takeaways

- Junk fees are often unexpected and not clearly justified, leading to consumer dissatisfaction and distrust.

- Credit card processing fees vary by transaction type and card used, impacting the cost for merchants which are often passed to the consumer as a service, convenience or surcharge for accepting credit card payments.

- Regulations are increasing against deceptive junk fees, with actions from bodies like the CFPB and FTC to ensure transparency.

- Junk fees often lack clear justification, leading to unexpected costs for consumers and affecting

- High processing fees can squeeze margins, especially for small businesses, affecting competitiveness and pricing strategies.

- State responses vary, with places like California enforcing strict regulations on junk fees will now also include credit card fee surcharging.

It’s also important to understand how closely these costs are connected to other common pricing strategies like drip pricing and surcharging.

- While junk fees are unexpected charges that aren’t directly tied to any specific service, drip pricing involves revealing the cost of a product or service incrementally, which can mask the true total cost until the final stages of a purchase.

- Similarly, surcharging, which is an additional fee added specifically for credit card users, directly impacts how much consumers end up paying and can influence payment method choices.

These pricing practices are interlinked as they all affect consumer perception, market transparency, and ultimately, the purchasing decision.

Here’s a full breakdown;

What is a Junk Fee?

Junk fee is a term that catches all those additional charges that often appear unexpectedly during transactions.

These fees can significantly inflate the cost of services or purchases, frequently hidden and disclosed only at the point of sale.

Unlike standard service fees, which cover actual costs of providing a service, junk fees often lack clear justification and can feel arbitrary or deceptive to consumers.

Examples of common junk fees include;

- Service charges: Added to bills in sectors like hospitality or services without direct correlation to service improvements.

- Processing fees: Attached to ticket sales, loan applications, or real estate transactions, often labeled as “handling” or “administration” fees.

- Resort fees: Common in hotels and resorts, charged daily for amenities that are sometimes unrequested or underutilized.

- Preparation fees: Fees for preparing documents or reports that may not require the level of effort implied by the fee.

Why are Junk Fees Problematic?

Junk fees distort the true price of products and services, complicating the decision-making process for consumers.

They tend to undermine trust between consumers and businesses when fees appear hidden or manipulative.

Additionally, these fees can disproportionately impact financially vulnerable populations who may not be able to afford unexpected costs.

Here’s why:

Lack of Transparency and Unexpected Costs

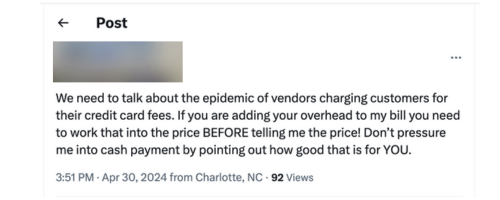

Junk fees are often not disclosed clearly or comprehensively at the time of a transaction, leading to consumer surprise and dissatisfaction when the final bill is higher than expected.

Distortion of consumer choices

Since junk fees significantly increase the overall cost of a service or product, they distort the true price and value, which affects consumer behavior.

Consumers may opt for a product or service based on an inaccurately low advertised price, only to find it much costlier at the point of sale.

Market competition and fairness

Junk fees create an uneven playing field in the marketplace. Businesses that don’t charge these fees might appear more expensive upfront and lose customers to competitors who add extra fees later in the purchasing process.

This not only affects competition but also discourages pricing transparency and fairness in the market.

In response to growing concern over these practices, regulatory bodies like the Consumer Financial Protection Bureau (CFPB) are stepping up scrutiny.

The CFPB, for example, has initiated steps to investigate and potentially limit the imposition of junk fees that they believe are unfair to consumers.

Their aim is to reduce the financial burden on consumers and also to foster a more transparent marketplace.

Drip Pricing

Drip pricing is a pricing strategy where a business initially presents a low base price to attract customers, only to add additional fees or charges as the customer progresses through the purchasing process.

This method often results in a final price significantly higher than the initially advertised price.

Mechanics of drip pricing involves;

Stage 1: The Attraction

Customers are drawn in by an attractively low price advertised online or in promotional materials.

Stage 2: The Increment

As the customer moves forward, incremental fees are introduced. For example, in online booking for hotels, this might include service charges, resort fees, taxes, or mandatory cleaning fees.

Stage 3: The Checkout

By the time the customer reaches the payment stage, the cumulative cost is considerably higher than expected.

Consumers reaction to drip pricing also varies:

Immediate Abandonment: Some consumers abandon the transaction once they realize the total cost at the last stage.

Reluctant Acceptance: Others may proceed with the purchase but with reduced likelihood of returning, especially if they feel they have no better alternatives.

Given its potential to mislead consumers, drip pricing has caught the attention of regulators.

In 2024, the FTC increased its enforcement against deceptive pricing practices, arguing that transparency in pricing is not just ethical but also crucial for fair competition.

Companies found violating transparency standards have faced significant fines and were required to compensate affected consumers.

In essence, while drip pricing may initially seem like a clever way to attract customers with lower prices, the strategy can backfire by damaging consumer trust and loyalty.

Transparency fosters a positive customer relationship and also aligns with increasing regulatory demands for fair marketing practices.

Surcharging

Surcharging represents an additional fee that merchants add to a customer’s bill when they opt to use certain payment methods, particularly credit cards.

This practice is used to cover the processing costs associated with credit card transactions, essentially passing a portion of this expense to the consumer.

How Surcharging Works

- Fee Application: Surcharges are specifically tied to the use of credit cards. When a customer chooses to pay with a credit card, the merchant adds a percentage-based fee (typically 3%+) on top of the purchase price to cover the processing fees charged by credit card companies.

- Disclosure: Regulations often require that these fees be clearly disclosed to consumers before the transaction is completed, ensuring that customers are aware they will pay more than the listed price if they use a credit card.

Surcharging differs from other fees like junk fees or drip pricing in several key aspects:

- Direct association with payment method: Unlike junk fees, which may appear arbitrary or unrelated to specific costs, surcharges are directly linked to the use of credit cards and are intended to cover specific processing expenses.

- Regulatory Compliance: Surcharging is heavily regulated. In many jurisdictions, the ability to add surcharges is governed by strict rules, including the need for clear disclosure and caps on the percentage that can be charged.

- Consumer Choice: Unlike drip pricing, where additional costs are revealed incrementally and can affect all buyers, surcharges are only applied if the consumer opts to use a credit card, providing a level of choice in some instances but in our digital-focused economy cash is almost no longer an option.

Some consumers accept surcharges as a reasonable trade-off for the benefits of credit card use, such as convenience, security, and rewards.

Others may view them as an unwelcome additional cost, especially if they are not used to paying them.

For businesses, implementing a surcharge can offset costs but may also discourage some customers from making purchases, particularly if competitors do not impose similar charges.

One of the main challenges is that surcharging is making it worse; adding 3%+ to the cost of everything, outpacing the already overinflated market.

While the consumer, business, and credit card processor are all involved, it is ultimately the processor who benefits the most. In addition to the surcharge, which is added on the consumers payments, the processors takes additional 3% in fees.

This leads to negative perception of the business, higher cost for the consumer, and a substantial profit for the processor.

Legislation and Regulatory Actions Targeting Junk Fees

There has been increasing regulatory scrutiny and legislative action aimed at reducing or eliminating junk fees.

These fees, often seen as deceptive or unfair, have prompted both federal and state-level initiatives designed to protect consumers and ensure pricing transparency in various industries.

Current National Initiatives Against Junk Fees:

The federal government has intensified efforts to clamp down on junk fees across a range of sectors.

One of the key measures includes proposals by the Consumer Financial Protection Bureau (CFPB) to enhance transparency and fairness for consumers.

Consumer Financial Protection Bureau (CFPB) Initiatives: In response to widespread consumer complaints, the CFPB launched a crackdown on junk fees in 2023. It has proposed new rules requiring clearer disclosure of fees in sectors such as banking, real estate, and entertainment. For instance, the CFPB is pushing for banks to display all potential fees upfront when opening an account or applying for loans.

Federal Trade Commission (FTC) Enforcement: The FTC has also taken steps to combat deceptive fee practices. In 2024, it settled a major case with a national ticketing company, which agreed to pay millions in refunds for not adequately disclosing service fees added at the end of the purchasing process.

State-Specific Legislation

Several states have enacted their own laws to address the issue of junk fees, with legislation varying widely in scope and effectiveness.

California’s Consumer Protection Law: Effective from July 2024, California implemented stringent laws requiring all service providers to disclose any additional fees before a transaction is finalized. This law covers industries ranging from automotive sales to online retail.

New York Transparency Act: New York passed the transparency Act, mandating that any fees that could be considered “non-essential” must be included in the advertised price of a service or product. This act was particularly aimed at reducing hidden fees in the travel and leisure sectors.

Impact of Legislation on Junk Fees for Businesses and Consumers

The introduction of stricter legislation around junk fees carries significant implications for both businesses and consumers, reshaping their interactions and the transparency of financial transactions.

For Consumers:

Enhanced Trust and Confidence

Consumers are more likely to feel secure in their purchasing decisions when they understand the full cost upfront. This transparency helps in building trust, as buyers do not feel misled by hidden costs that accumulate by the end of their purchasing process.

Reduced Disputes

With clearer pricing, there is less ambiguity about the cost of services and products, which leads to fewer disputes over charges.

Consumers are less likely to question or contest charges that they were made aware of at the beginning of a transaction.

This clear communication helps in reducing conflicts between service providers and consumers, leading to smoother transaction experiences.

For Businesses:

Adaptation to New Compliance Requirements:

Businesses have had to adjust their pricing models to comply with these new regulations.

The adaptation might involve overhauling how prices are presented and explained to consumers, ensuring all potential fees are disclosed upfront.

Potential Initial Challenges with Sales

While transparency generally fosters consumer trust, businesses might initially experience a dip in sales as prices appear higher without hidden fees.

This adjustment period is critical as businesses reposition their marketing strategies to highlight value over low upfront costs.

Long-Term Customer Loyalty

In the long run, businesses that adhere to these regulations and prioritize transparency are likely to see improvements in customer loyalty.

Consumers appreciate straightforward pricing and are more likely to return to a business that respects their right to clear information.

Overall, the legislative crackdown on junk fees is shaping a more transparent marketplace where consumers can make more informed decisions, and businesses can build deeper trust with their customers.

While the transition requires adjustments and can pose short-term challenges for businesses, the long-term benefits of increased consumer trust and reduced disputes are substantial.

How Junk Fees Distort Competition

Junk fees distort market competition by creating an uneven playing field where transparent pricing is not the norm.

These hidden charges affect consumer trust and complicate the ability of customers to compare prices effectively across providers.

As regulations become stricter and consumer awareness grows, companies must reconsider their pricing and marketing strategies to remain competitive and compliant.

Impact on Price Transparency

Junk fees obscure the true cost of products and services, making it challenging for consumers to make informed purchasing decisions.

For example, two competing hotels might list the same rate for a night’s stay, but one might charge additional ‘resort fees’ that the other does not.

This lack of transparency misleads consumers into initially choosing a seemingly cheaper option, only to find out it’s more expensive after all fees are applied.

Consumer Decision-Making

When the full cost of a product or service isn’t clear upfront, it impairs the consumer’s ability to compare prices effectively. This scenario can lead to a decision-making process based not on the best value but on incomplete information.

Over time, this will erode trust in market segments where junk fees are prevalent, as consumers may grow wary of potential hidden costs.

Competitive Disadvantage for Transparent Businesses

Companies that choose to adopt a transparent pricing model may find themselves at a competitive disadvantage if their initial visible costs appear higher than those of competitors who add junk fees later in the purchasing process.

Market Entry Barriers

New entrants to the market may face significant challenges if competing against established players that use junk fees to artificially lower the advertised price of their services or products.

New businesses often strive to build customer trust through transparent practices but may feel pressured to adopt similar junk fee strategies to compete effectively.

Regulatory Response and Market Correction

As awareness of these issues grows, regulatory bodies have begun to intervene. For example, in sectors like telecommunications and hospitality, regulators have started enforcing more stringent disclosure requirements and have cracked down on misleading advertising practices.

This regulatory pressure is gradually reshaping how companies structure their pricing, pushing the market towards greater transparency.

Also, in response to these market distortions and increasing regulation, companies are now reevaluating how they price and market their products.

The shift involves:

Incorporating All Fees into Advertised Prices: Some companies are moving towards an all-inclusive pricing model where all potential fees are included in the price shown to consumers.

Improving Fee Disclosure: Others are improving the clarity and timing of fee disclosures to ensure consumers are aware of all costs upfront.

Enhancing Marketing Communication: Companies are also refining their marketing messages to highlight transparency as a key selling point, thereby attracting consumers who value straightforward pricing.

Is Credit Card Fee Surcharging a Junk Fee

First, it’s important to clear up some confusion. Many people mix up credit card “late” fees with credit card surcharges when talking about “junk fees.”

Let’s clarify: credit card processing fees are essential costs that businesses must handle when accepting credit card payments.

These fees are paid to a combination of credit card networks, issuing banks, and payment processors.

On the other hand, credit card surcharges are fees that merchants add on top of the purchase price for customers who choose to pay with a credit card.

Credit card processing involves several types of fees, each contributing to the overall cost of accepting credit card payments:

1. Interchange Fees

These are fees paid to the card-issuing bank to cover handling costs, fraud and bad debt costs, and the risk involved in approving the payment.

Typically, these fees constitute the largest portion of credit card processing expenses.

2. Assessment Fees

Charged by the credit card networks (Visa, MasterCard, American Express, etc.) for using their networks. These fees are smaller than interchange fees but are still significant.

3. Payment Processor Fees

These are fees charged by the payment processing company for their services, which include transaction processing, merchant account services, and payment gateway provision.

4. Additional Fees

These might include fees for setup, monthly usage, minimum usage penalties, transaction fees, and charges for chargebacks or refunds.

The Complexities of Credit Card Processing Fee

As the landscape of financial transactions becomes more complex, the distinctions between different types of fees become increasingly significant. These can include interchange fees, assessment fees, and additional charges levied by payment processors, banks and resellers for facilitating transactions.

Combined, credit card processing fees for merchants can be complex and variable, typically ranging from 1.5% to over 3.5% per transaction.

As an example Interchange fees are influenced by several factors:

- Card Type & Brand: Different cards (credit vs. debit and Visa, MasterCard or Amex) all have different fees associated with them.

- Transaction Method: Whether the card is swiped, inserted, or keyed-in affects the fee due to differing levels of risk associated with each method.

- Security Features: Enhanced security features can affect processing costs.

- Rewards Programs: Cards offering rewards typically have higher interchange fees that merchants must cover.

Interchange reimbursement published by Visa and Mastercard show over 1500 different card types and tiers. See one of the guides.

Credit card processors impose fees above Interchange and have complex billing models. For example, flat rate pricing models from companies like Square, Stripe and Quicbooks might seem straightforward but can end up costing merchants more than necessary.

Debit card interchange fees might start as low as 0.25%, but flat rate pricing pushes these fees into the range of 2.79% + $0.30 per transaction.

Just imagine this type of fee structure on a $5 transaction, the result pushes the cost for payments upwards of 8%.Maybe this math can better educate consumers on why companies have minimum spends when accepting credit cards.

These costs significantly impact the overall financials of a business, particularly small businesses with tight margins.

Predatory Pricing Issues

The credit card processing industry faces criticisms for what some see as predatory pricing practices.

Additional layers of fees can be added by credit card processing companies above these Interchange fees, sometimes adding as much as 300 basis points (or 3%) to the already complicated fee structure.

The opacity of credit card statements and the arbitrary addition of fees under the guise of regulatory or compliance enhancements complicate the issue further, making it difficult for merchants to anticipate the true cost of accepting credit cards.

Despite these challenges, there is currently no dedicated regulatory body specifically overseeing these practices within the credit card processing industry.

This lack of oversight means that fees can be increased with minimal notice, significantly affecting merchants.

Regulations on Credit Card Fee Surcharging

Credit card processing fees are an integral part of the modern payment landscape, but they are increasingly scrutinized from both regulatory and consumer perspectives.

This scrutiny arises from concerns over transparency, fairness, and the overall impact of these fees on market dynamics.

Potential Regulation

Regulatory bodies are contemplating whether some aspects of surcharging qualifies as “junk fees” — unnecessary or excessively high charges that do not correspond to the service provided.

This consideration could lead to new regulations designed to make fee structures more transparent and fair:

Federal Level Initiatives: Agencies like the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) are examining credit card processing fees to determine if they unfairly burden consumers and merchants, and if they should be capped or more clearly disclosed.

Transparency and Disclosure: There is a push for regulations that would require clearer disclosure of all credit card processing fees upfront, ensuring that merchants and consumers understand the full cost of these services.

Recent Developments

In a significant move addressing these concerns, Senators Dick Durbin and Roger Marshal recently announced a bipartisan settlement with Visa and Mastercard. This settlement aims to tackle the issue of excessive “swipe fees” these credit card companies charge to merchants.

According to the, Visa and Mastercards will make adjustments to their fee structure to alleviate the strain on U.S merchants, ensuring the costs are more in line with the service provided.

This development is a step to transparency and fairness in the credit card processing industry, potentially settling a precedent for future regulatory actions.

State Responses to Surcharging

Different states have taken varied approaches to managing credit card processing fees surcharges, reflecting diverse regulatory philosophies:

Credit card surcharging, where merchants add an additional fee to transactions paid with a credit card to cover processing costs, is subject to both federal guidelines and state laws. Here’s a summary of the state laws regarding credit card surcharges:

Federal Law: Allows a maximum surcharge of 4% on credit card transactions. Debit card surcharging is illegal in all 50 states.

Connecticut, Maine, Massachusetts: Surcharging credit card transactions is illegal.

Colorado: Allows credit card surcharging up to 2%.

Illinois: Permits surcharging up to 1%, or the cost of the processing fee, whichever is less.

New York, New Jersey, Nevada, South Dakota: Prohibit surcharges from exceeding the cost that the merchant pays to accept the card.

Texas: Prohibits surcharging but allows convenience fees, service fees, and cash discounts.

California, Kansas: Had anti-surcharging laws that were overturned by federal courts. Merchants must include credit card fees in the listed price to legally impose a surcharge.

Alabama: Surcharging is legal as long as it meets federal guidelines.

Alaska: No state law prohibits merchants from adding a surcharge to credit card transactions.

Arizona: Legal to surcharge credit card transactions.

This ongoing debate over credit card processing fees and surcharges is likely to result in more definitive regulations that aim to balance the needs of consumers, businesses, and payment processors.

Key areas of focus include:

Standardization of Fees: There may be efforts to standardize fees across states to prevent a patchwork of regulations that can confuse consumers and burden interstate commerce.

Enhancing Competition: By regulating these fees, there could be an opportunity to enhance competition among credit card processors, potentially leading to lower costs for merchants.

If you can’t surcharge consumers, at least reduce your expenses!

At Payment Brokers, we understand the challenges businesses face with junk fees and complex credit card processing charges.

Leveraging over 20 years of industry experience, we specialize in reducing these costs through expert negotiation and AI-powered analysis, without the need for changing your existing payment processors, hardware, or software.

Our Approach

Fee Analysis and Optimization: We conduct thorough audits of your current payment processing fees and contracts to identify unnecessary charges and areas for cost reduction.

Negotiation and Renegotiation: Our team expertly negotiates with service providers on your behalf to lower or eliminate excessive credit card processing fees and any unjustified junk fees.

Ongoing Monitoring and Support: We provide continuous monitoring and reevaluation of your payment processing arrangements to ensure you always enjoy the best possible terms, adapting to any changes in the regulatory landscape.

Benefits to You and Your Business

Cost Savings: Minimize unnecessary expenditures on fees, increasing your overall profitability.

Enhanced Transparency: Gain a clearer understanding of the fees you are being charged and why, enhancing your ability to manage finances effectively.

No Impact to Operations: Our services does not require any changes to existing credit card processing vendors, no changes to equipment, software or POS systems, no applications or underwriting and no impact to their daily operations.

If you’re looking to cut credit card processing expenses and get ahead of the regulations for junk fees, reach out to us.