Big changes are on the horizon for the cannabis industry in the United States.

Recently, the government announced plans to reclassify cannabis, moving it from a Schedule I to a potentially less restrictive category. This reclassification signals a major shift in how cannabis is perceived at the federal level.

Currently, cannabis is classified alongside drugs like heroin and LSD, which are considered to have no medical use and a high potential for abuse.

This strict classification has historically posed numerous challenges for businesses in the cannabis industry, especially when it comes to accessing basic financial services like banking or loans.

A leap to the proposed Schedule III would put the plant and its products in the same class as medical treatments such as codeine and anabolic steroids.

The impact of this reclassification could be significant for financial services.

Banks previously hesitant to do business with cannabis-related companies might change their stance, leading to a surge in support and services for these businesses.

The latest FinCEN report as of May 2024 shows only about 706 banks and credit unions actively provided banking services to marijuana-related businesses. This is a small fraction, considering the finance industry has over 5,801 FDIC-insured institutions and another 5,733 NCUA-insured credit unions nationwide.

According to the FDIC data, that’s 11,652 total recognized and regulated financial institutions.

This move could not only help cannabis businesses flourish but also create a ripple effect through the financial sector, opening up new opportunities for investment, insurance, and more.

This article will cover what these changes could mean for the financial landscape.

To understand the implications of cannabis reclassification, let’s get some historical context.

Key Takeaways

- Reclassification could significantly expand access to banking and financial services for cannabis businesses, transitioning from a predominantly cash-based system to full banking integration, namely credit card processing solutions and the reduction of current expenses surrounding payments

- More tailored insurance and lending products could emerge, specifically designed to mitigate the unique risks of the cannabis industry, potentially lowering costs for businesses.

- Significant opportunities for fintech innovation in bespoke payment solutions, enhanced compliance tools, and blockchain-based secure transaction systems, catering to the specific needs of the cannabis industry.

- Despite potential benefits, reclassification to Schedule III would still involve complex federal regulations, maintaining a compliance challenge across state lines.

- Lower barriers to entry could lead to increased competition, market saturation, and price wars, potentially impacting the sustainability of existing businesses.

- The attraction of more investors due to a reduced risk profile and an expanded legal market, throughthough increased competition, could disadvantage smaller, less capitalized companies.

- Easier access to conducting research could lead to more robust scientific studies and innovation in cannabis-related medical treatments.

- U.S. reclassification could influence global drug policy reforms, potentially leading to significant shifts in international cannabis regulation and perception.

Background on Cannabis Regulation

Cannabis was not always a controversial substance in the United States. In fact, before the 20th century, it was widely used for medicinal and recreational purposes.

However, the landscape began to change drastically with the Marijuana Tax Act of 1937, which effectively criminalized marijuana, laying the groundwork for decades of strict regulations.

The 1970s also marked a significant turn with the initiation of the War on Drugs.

The 1970 Controlled Substances Act categorizes cannabis as a Schedule I drug—reserved for substances with no currently accepted medical use and a high potential for abuse.

This classification put cannabis on par with drugs like heroin, significantly hindering research into its potential benefits and criminalizing its use.

Despite federal restrictions, individual states began opposing the national policy in the late 20th century.

California was the first state to legalize medical marijuana in 1996, sparking a movement that led to numerous other states following suit.

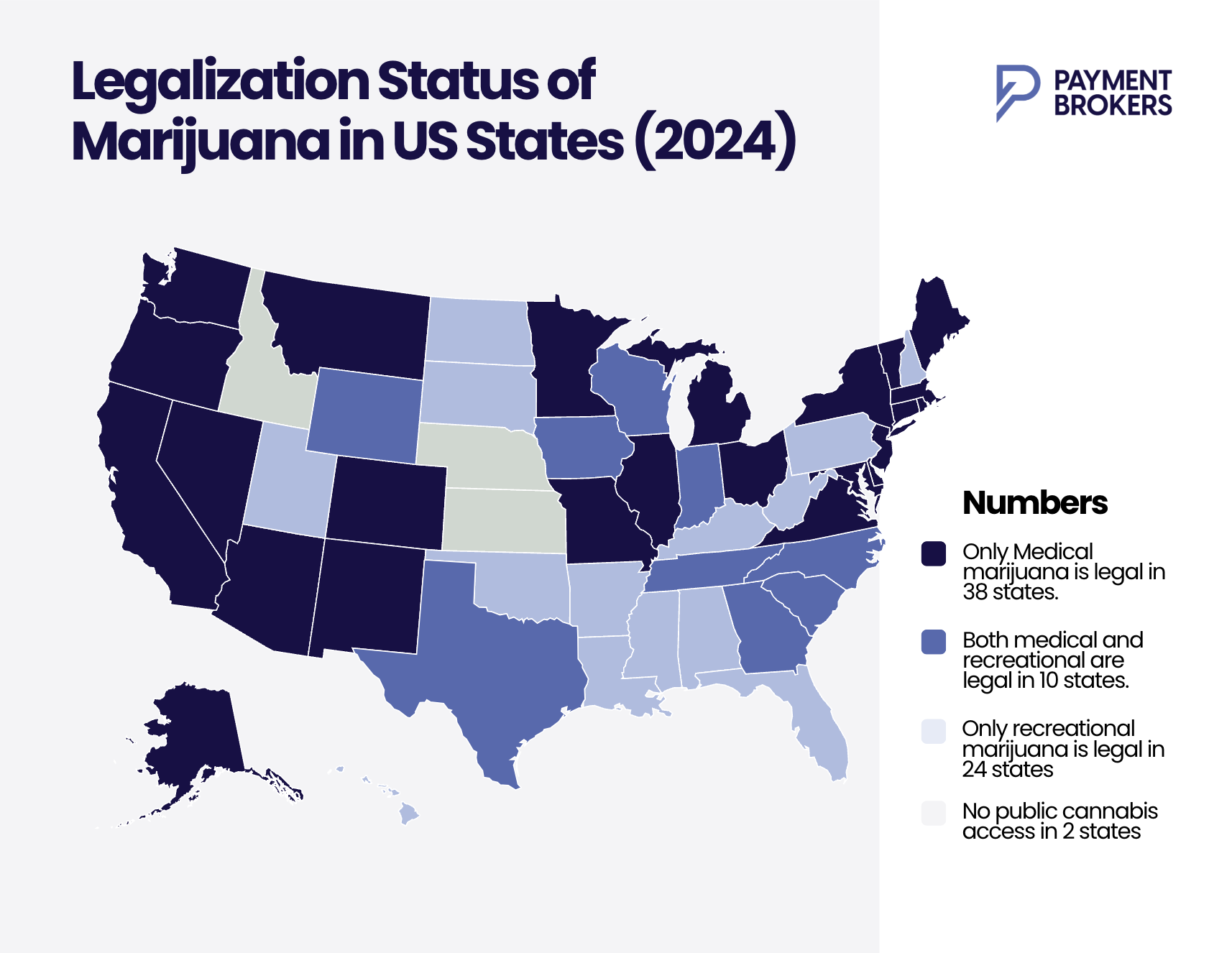

As of May 2024, the NCSL report shows medical marijuana is legal in 38 states, and recreational use is legal in 24 states and Washington, D.C.

The divergence between state and federal law has created a complex regulatory environment, particularly for financial services.

Due to federal laws, banks and financial institutions that are federally regulated have largely shied away from offering services to cannabis-related businesses, fearing legal repercussions.

This has forced many businesses in the cannabis industry to operate on a cash-only basis, leading to various operational and security challenges.

Now, there seems to be a silver lining for the cannabis industry.

There has been a gradual shift in the federal stance over recent years.

Discussions around medical benefits, public sentiment, and the potential economic advantages of legalization have increased bipartisan support for reclassification or even full legalization.

This perspective has set the stage for the current discussions on reclassification.

Impact of Cannabis Being a Schedule I Drug on Banking and Financial Services

Here’s a deeper look at the current banking and financial restrictions affecting the cannabis industry and the challenges they impose:

1. Banking Access

Federal Regulations: Because cannabis remains a Schedule I drug at the federal level, banks that are federally insured face significant legal risks when providing services to cannabis-related businesses. This includes potential charges of money laundering and aiding in a federally illegal operation.

Limited Banking Options: As a result, many banks choose to avoid the cannabis sector altogether. According to a report from the Treasury Department’s Financial Crimes Enforcement Network (FinCEN), as of 2024, only a minority of financial institutions were willing to serve the cannabis industry. This forces many cannabis businesses to accept payments primarily in cash.

Operational Challenges: Operating in cash not only complicates everyday transactions but also poses significant security risks and logistical challenges, from payroll management to taxation.

2. Financing and Loans

Capital Access: The lack of banking relationships also means that cannabis businesses often struggle to access traditional forms of financing, such as business loans or lines of credit. This can inhibit growth, as companies have fewer resources for expansion or innovation.

High-Interest Rates: Some private lenders and credit unions that do provide financing to cannabis businesses often charge higher interest rates to mitigate the perceived risk, increasing the cost of capital for these businesses.

Exclusion from Federal Assistance Programs: As cannabis remains a federally prohibited substance, businesses in this industry are excluded from federal assistance programs such as Small Business Administration loans, which can be crucial for startups or small businesses.

3. Insurance and Risk Management

Limited Options: Insurance is another critical area where cannabis businesses face barriers. Many insurers, particularly those that are nationally chartered, are hesitant to engage with the cannabis industry because of its legal status at the federal level.

Increased Costs: Insurance companies offering services to the cannabis industry often charge premium rates. This not only affects operational costs but also impacts businesses’ ability to manage risk effectively.

4. Credit Card Processing

Payment Processing Restrictions: Due to federal prohibition, most major credit card companies do not process transactions for cannabis-related products. This limits businesses’ ability to accept non-cash payments, affecting both sales and customer convenience.

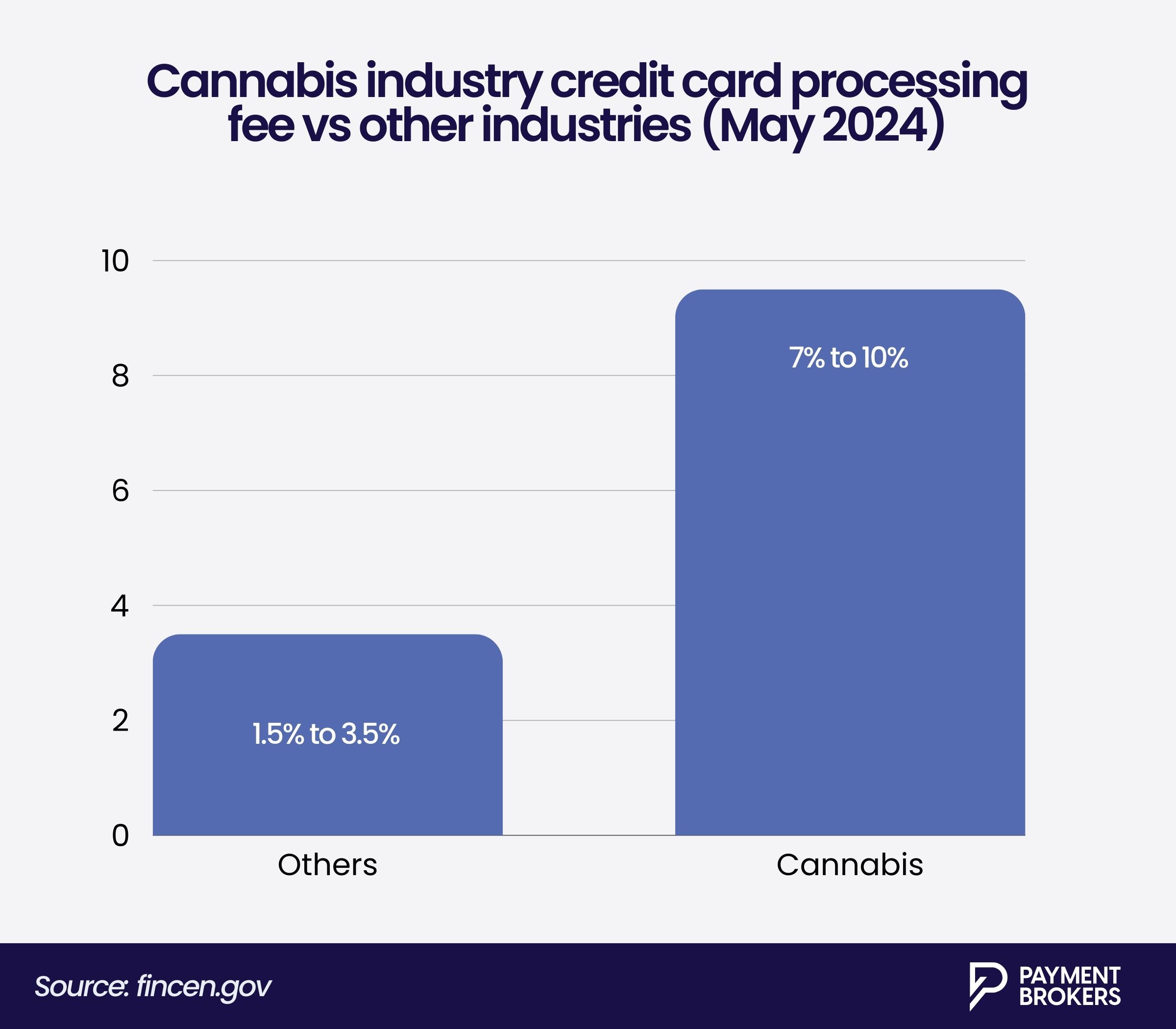

Additional Fees: Cannabis businesses face unusually high costs in credit card processing, with rates ranging from 7% to 10%, far exceeding the typical 1.5% to 3.5% in other industries. These businesses also endure heavy transaction fees and are required to maintain significant funds on hold, usually covering one to two months of processing revenue, with holds rotating every 30 to 90 days.

Furthermore, the strict chargeback threshold much lower than in traditional commerce—compels many to opt for cashless ATMs or expensive cash handling, which incurs added security, transportation, and insurance costs, driving the total expense potentially above 9%. This financial strain highlights the urgent need for specialized rate and fee reduction solutions in the cannabis sector.

5. Investment Hesitancy and Barriers

The uncertain regulatory environment makes many potential investors hesitant to invest in the cannabis industry. Despite the lucrative potential, the fear of federal intervention or policy shifts can deter investment from institutional and individual investors.

This complex web of financial restrictions not only stifles the growth and operational efficiency of cannabis businesses but also affects the broader economic potential of the industry.

Complete Overview of Cannabis Reclassification and Regulatory Update

The proposed reclassification of cannabis could have a considerable impact on the financial services sector by easing some of the current restrictions on banking and other financial services for cannabis businesses.

However, it is essential to note that reclassification alone will not solve all the challenges the industry faces.

For context, let’s look at the current reclassification proposal in more detail:

Potential Reclassification Status

No official reclassification has occurred, and the proposal is merely a step in that direction.

The proposal recommends moving cannabis from Schedule I to Schedule III, a class reserved for substances with accepted medical use and less potential for abuse.

The current Schedule I classification indicates a high potential for abuse and no accepted medical use. This has imposed stringent restrictions on research, banking, and commerce, significantly hampering the growth and operation of cannabis-related businesses.

Recommendation for Reclassification and Reject

The push for reclassification has gained momentum following an August 2023 recommendation by the U.S. Department of Health and Human Services (HHS) to the Drug Enforcement Administration (DEA).

This recommendation is part of a broader initiative by the Biden administration to amend federal cannabis policies, reflecting a more lenient approach towards cannabis-related activities and recognizing its medical potential.

Legislative and Policy Considerations

The HHS recommendation has yet to be finalized by the DEA, which has indicated that it is reviewing the proposal but has not yet issued a formal decision.

However, it’s important to note that this process is painfully slow, and the DEA is not obligated to follow the HHS recommendation.

This isn’t the first time such a recommendation has been made.

In 2026, the HHS made a similar recommendation to remove cannabis from Schedule I, but the DEA ultimately rejected it.

The process involves a complex interplay of scientific, medical, and legal evaluations to determine the appropriate drug scheduling.

So, it’s still too early to predict if this recommendation will lead to concrete changes in federal regulations.

However, the fact that such a recommendation has been made, especially under a more progressive administration, is an encouraging sign for the industry.

Moving cannabis to Schedule III would alleviate many of the current restrictions:

Banking and Finance: Businesses would face fewer hurdles in accessing banking services, as the reduced restrictions would likely encourage more financial institutions to serve cannabis-related businesses. This could also help mitigate the predominance of cash transactions within the industry.

Taxation: Reclassification would exempt cannabis businesses from the onerous requirements of IRS 280E, which disallows business expense deductions for enterprises trafficking Schedule I or II substances. This change would enable these businesses to claim deductions and access tax credits similar to other legal businesses, potentially easing the financial burden on these companies.

Research and Development: Schedule III status would substantially ease the process of cannabis research, facilitating more comprehensive scientific studies and innovation within the industry. This is crucial for advancing understanding and acceptance of cannabis’s therapeutic benefits.

Let’s look closely at how this could affect the financial finch sector.

Implications and Opportunities of the Reclassification for the Fintechs

1. Expansion of Financial Services to Cannabis Businesses

Access to Banking: Due to federal banking restrictions, cannabis businesses have traditionally been largely cash-based. With the reclassification, these businesses could finally gain access to banking services like checking accounts, loans, and credit lines. We could see a world where a local dispensary can accept credit cards or secure a loan to expand operations—this would revolutionize how they operate day-to-day.

Payment Processing: Fintech companies have an opportunity to provide bespoke payment solutions that cater specifically to the cannabis sector. Beyond traditional payment processing, fintech startups could develop a secure, blockchain-based payment system that ensures transactions are transparent and compliant with state regulations.

2. Regulatory Compliance and Reporting

Enhanced Compliance Tools: The legal landscape for cannabis varies by state. Fintech can offer dynamic tools that help businesses ensure they’re not only tracking their sales and inventory accurately but also staying on top of changing regulations. These tools could use real-time data to alert businesses of necessary compliance adjustments as laws evolve.

Anti-Money Laundering (AML) and Know Your Customer (KYC): Given the high scrutiny in the sector, developing stringent AML and KYC protocols is crucial. We’ll see the rise of advanced AI-driven systems that conduct deep background checks and continuous monitoring to flag any suspicious activities instantly.

3. Data Security and Privacy

Data Management: As cannabis companies move online, securing sensitive customer data becomes paramount. Blockchain technology could be utilized here to encrypt transaction records, ensuring they are immutable and traceable, significantly reducing the risk of breaches.

Confidentiality: Providing platforms where customer data is not only protected but also anonymized can help cannabis businesses build trust with their clientele, knowing their information is safe from prying eyes.

4. Custom Financial Products

Tailored Insurance and Lending Products: The unique risks associated with the cannabis industry—like crop failure or regulatory changes—require equally unique financial products. Now, fintechs can collaborate with insurance providers to offer policies designed for these risks.

Investment Opportunities: As the stigma around cannabis decreases, more investors are looking for opportunities. We may see the rise of cannabis-focused investment funds or bonds, providing a gateway for seasoned and novice investors to enter this burgeoning market.

5. Integration with Existing Financial Systems

Seamless Integration: The goal is for fintech solutions to work smoothly with traditional financial systems. This might involve developing APIs that allow easy data transfer between systems, ensuring businesses can manage their finances in one place without hassle.

Partnerships and Collaborations: By forming strategic partnerships with established financial institutions, fintech firms can provide a more robust service offering that includes everything from payment processing to regulatory compliance, making it easier for banks to serve these businesses without taking undue risk.

6. Educational and Advisory Services

Advisory Services: Ongoing changes in cannabis legislation necessitate continuous advisory services. Fintech firms could position themselves as experts in cannabis finance, helping businesses navigate the complex regulatory environment with consultative services.

Educational Platforms: Consider platforms that offer seminars, webinars, and e-books on financial best practices, legal compliance, and market trends in the cannabis industry. This not only helps businesses thrive but also establishes the fintech firm as a thought leader in this space.

Other Key Implications of Cannabis Reclassification Often Overlooked

Not all implications of cannabis reclassification may be immediately apparent, but a few are so important that they would determine the success of the entire initiative.

1. Intensified Market Competition

Reclassification could make the cannabis industry more accessible, reducing barriers that have previously deterred mainstream financial services and larger corporate entries.

As a result, the market may see an influx of new players, which could drive intense competition and possibly lead to price wars and market saturation.

This could place significant pressure on existing cannabis businesses, challenging their profitability and market positions.

2. Increased Regulatory Oversight

Shifting cannabis to Schedule III acknowledges its medical utility but also subjects it to stricter FDA regulations.

These could include precise requirements around the production, marketing, and distribution of cannabis products, impacting how businesses operate and comply.

The increased regulatory framework could drive up operational costs and set higher barriers to entry for new businesses.

3. Shifts in Consumer Perception and Behavior

The reclassification might alter public perception, potentially shifting cannabis from a stigmatized substance to a recognized medicinal product.

This change could influence consumer spending patterns, with an increased demand for products marketed for their health benefits.

However, this shift might also affect the recreational use market, which could change consumer loyalty and product preference.

4. Operational Challenges for Small Businesses

While reclassification could alleviate some financial strains by allowing cannabis businesses to deduct typical business expenses, small operations might find it difficult to compete with well-funded companies.

The heightened competition and complex regulatory requirements could disproportionately affect these smaller entities, pushing them to the margins unless they innovate or find niches within the evolving market.

5. Enhanced Research Opportunities

Currently, the stringent classification of cannabis as a Schedule I drug significantly hampers research due to tight restrictions on its use in scientific studies.

Reclassification could open the doors to more comprehensive research, fostering a better understanding of cannabis’s medical benefits and potential risks.

This could lead to new medical applications and treatments being developed, further expanding the industry’s scope.

7. Legal and Compliance Costs

While the potential benefits are considerable, cannabis businesses will likely face new costs related to compliance and adapting to new legal standards.

These could range from revamping operational practices to investing in compliance infrastructure, which could be particularly burdensome for smaller players.

Industry and Public Reaction to The Reclassification

The potential reclassification has been met with broad support from various stakeholders within the cannabis industry, who anticipate that such a change would promote growth and reduce legal ambiguities.

Advocacy groups and industry leaders have emphasized the significance of this move in correcting historical injustices associated with cannabis prohibition and in fostering a more equitable regulatory environment.

This reclassification is a historic step in the gradual shift towards more rational cannabis policies that align more closely with the current understanding of the drug’s risks and benefits.

However, stakeholders remain vigilant, awaiting final decisions and ready to adapt to the evolving legal landscape.

Key Challenges to Consider in the Proposed Cannabis Classification

1. Regulatory Complexity

Even with the shift to Schedule III, cannabis remains a controlled substance, which means it will still be subject to federal regulation.

This could perpetuate existing conflicts between state and federal laws, leading to a complex regulatory environment for businesses and consumers.

Although Schedule III status reduces some barriers, it doesn’t fully harmonize the varying state laws and federal regulations, potentially leaving a patchwork of compliance requirements that could confuse and burden businesses.

2. Continued Research Limitations

While moving to Schedule III lowers some barriers to research, significant obstacles remain.

The DEA still controls the licensure process for cannabis research, which can delay or restrict the types of cannabis studies that are permitted.

This could continue to hinder the development of a robust body of research on cannabis’ medical benefits and safety, which is essential for its acceptance and integration into mainstream medical practice.

3. Economic and Market Challenges

Reclassification to Schedule III alters the economic landscape for the cannabis industry by enabling businesses to deduct ordinary business expenses under IRS tax codes and potentially enhancing access to banking services.

However, these changes may disproportionately benefit well-capitalized businesses, potentially squeezing out smaller, minority-owned, or less-funded operations.

Increased FDA oversight could also impose new financial pressures on the industry, causing additional costs and barriers.

4. Social and Cultural Impact

While reclassification can help reduce the stigma associated with cannabis by acknowledging its medical utility, it does not completely destigmatize its use.

Public perception is slow to change, and federal control as a Schedule III drug still implies significant health risks or abuse potential, which could continue to influence public opinion negatively.

5. International Implications

The U.S. plays a significant role in international drug policy. A shift in how cannabis is classified could prompt reevaluations of drug policies internationally.

However, global drug treaties and international law complicate these changes, potentially putting the U.S. at odds with international agreements unless further reforms are pursued globally.

Overall, the potential reclassification of cannabis to Schedule III is a step towards a more rational drug policy but comes with a complex array of challenges that need careful management to ensure that the benefits are realized across all levels of society and industry.

FAQ on Cannabis Reclassification and Fintech Impact

1. Which body controls drug classifications?

Drug scheduling in the U.S. is primarily overseen by the DEA, which operates under the authority of the Department of Justice (DOJ).

2. What is the current status of cannabis reclassification?

As of June 2024, cannabis remains a Schedule I drug. The HHS has recommended moving it to Schedule III, but this has yet to be finalized by the DEA.

3. How does this affect current state laws on cannabis?

This move does not change the legality of cannabis. Cannabis remains prohibited at the federal level, regardless of state laws, which may differ according to state and local legislation.

4. What are the potential opportunities for fintechs in this space?

Fintechs can offer a range of financial services and solutions to cannabis businesses, including banking, insurance, and compliance tools.

5. Will the reclassification have any implications for research on cannabis?

Reclassification to Schedule III could make it easier for researchers to access and study cannabis, but significant barriers remain, and the DEA still controls the licensure process.

6. What are the potential economic implications of this reclassification?

Reclassification could alleviate some financial challenges for cannabis businesses, such as tax deductions and access to banking services. However, increased FDA oversight and a potentially more competitive market could pose new challenges.

7. How might this reclassification impact public perception of cannabis?

While reducing the stigma of cannabis, the Schedule III classification could perpetuate negative perceptions by still classifying it as a controlled substance with potential for abuse.

8. How could this reclassification affect international drug policy?

Reclassification could prompt other countries to reevaluate their drug policies, potentially leading to more significant changes globally. However, this would require international cooperation and possibly changes to international drug treaties.

9. Could blockchain and cryptocurrencies become more significant in cannabis financial services?

Absolutely. Blockchain offers transparency and security, which could be beneficial for tracking cannabis sales and ensuring compliance with regulations. Cryptocurrencies might also provide an alternative payment method for customers looking to maintain privacy. Imagine combining the security of a vault with the efficiency of digital transactions.

Payment Brokers Strategic Response to the Reclassification of Cannabis

We are actively monitoring the situation and evaluating its potential implications for our clients and the broader fintech and payment processing sectors.

Our role and involvement

As specialists in providing comprehensive payment cost reduction solutions, we understand the importance of staying ahead of regulatory changes that impact our industry. Our team is engaged in:

- Regulatory Analysis: We are working with legal and compliance experts to analyze the potential shift from Schedule I to Schedule III and its implications for payment processing within the cannabis industry.

- Strategic Consultations: We are holding discussions with key stakeholders, including financial institutions, to prepare for possible changes in the banking and financial services available to businesses dealing in cannabis.

- Technology Adaptation: Our technology team ensures that our systems are adaptable to accommodate changes in cannabis’s legal status. This includes updates to ensure compliance, risk assessment, and fraud prevention.

Preparations for the shift

- Compliance and Legal Framework: We are revising our compliance frameworks to align with the potential new regulatory environment. This involves preparing to handle the intricacies of transactions involving cannabis-related businesses under a new legal status.

- Client Support and Updates: We are committed to keeping you informed and supported through this transition. Expect regular updates as we gain more clarity and concrete information from regulatory bodies.

- Educational Initiatives: We plan to host webinars and provide informational resources to help all our clients understand the new regulatory landscape and its impact on their businesses.

Looking ahead

While the DEA’s final decision is pending, we are not waiting to prepare. Our proactive approach ensures that should the reclassification occur, Payment Brokers and our clients will be prepared to navigate this new territory to help reduce payment related expenses and find more traditional payment solution options.

Feel free to reach out if you have more specific questions or need further clarification on how these potential changes might directly affect the cost of payments for your business.

Your success and security remain our highest priority, and we are here to support you every step of the way.