Your AI-Powered Payments Partner

We’ve harnessed the power of machine learning to redefine how payment processing services are analyzed and optimized, providing a new level of insight and opportunity for savings, and we do so with no impact to your current vendors, systems or operations.

Meet Ai.nalysis™

“AI.nalysis allows us to review years of statements and find thousands of dollars in near real time.”

Tech-Enabled, People Powered

“Our efficiency may be enabled by tech, but our value is in the people powered services that go beyond what tech alone can provide.”

Jeremy Lessaris

Founder & CEO, Payment Brokers

How it Works

We take pages of line items on otherwise unreadable statements, and contract clauses and turn them actionable insights that will impact your bottom line.

AI-Contract Review

We take a comprehensive, machine learning approach to analyzing your contract, going line by line to identify risks, challenges and opportunities. We carefully examine the terms of your current service provider for contractual flexibility, cancellation policies or the potential for liquidated damages to determine the best possible outcome for negotiations.

Our AI technology works tirelessly, dissecting every component of your contract to ensure that all of your contractual obligations are properly accounted for, and that any potential risks associated with the contract are identified and accounted for during contract negotiations.

Forensic

Statement Analysis

Navigating the labyrinth of credit card processing statement analysis can be a near impossible task. Statement analysis is much more complicated than simple percentages and transaction fees. It requires advanced knowledge including;

- Complicated interchange and implementation timelines

- Deceptively labeled dues and assessments

- Complex regulatory and compliance requirements

- Risk reduction through EMV, PIN & Level 2 & 3

- Technology use (tokenization, card updater, AVS etc…)

Our advanced AI model simplifies this process with an ability to analyze vast amounts of transaction level detail at lightning speed, leveraging machine learning variables to decode, categorize and identify opportunities for rate and fee reductions.

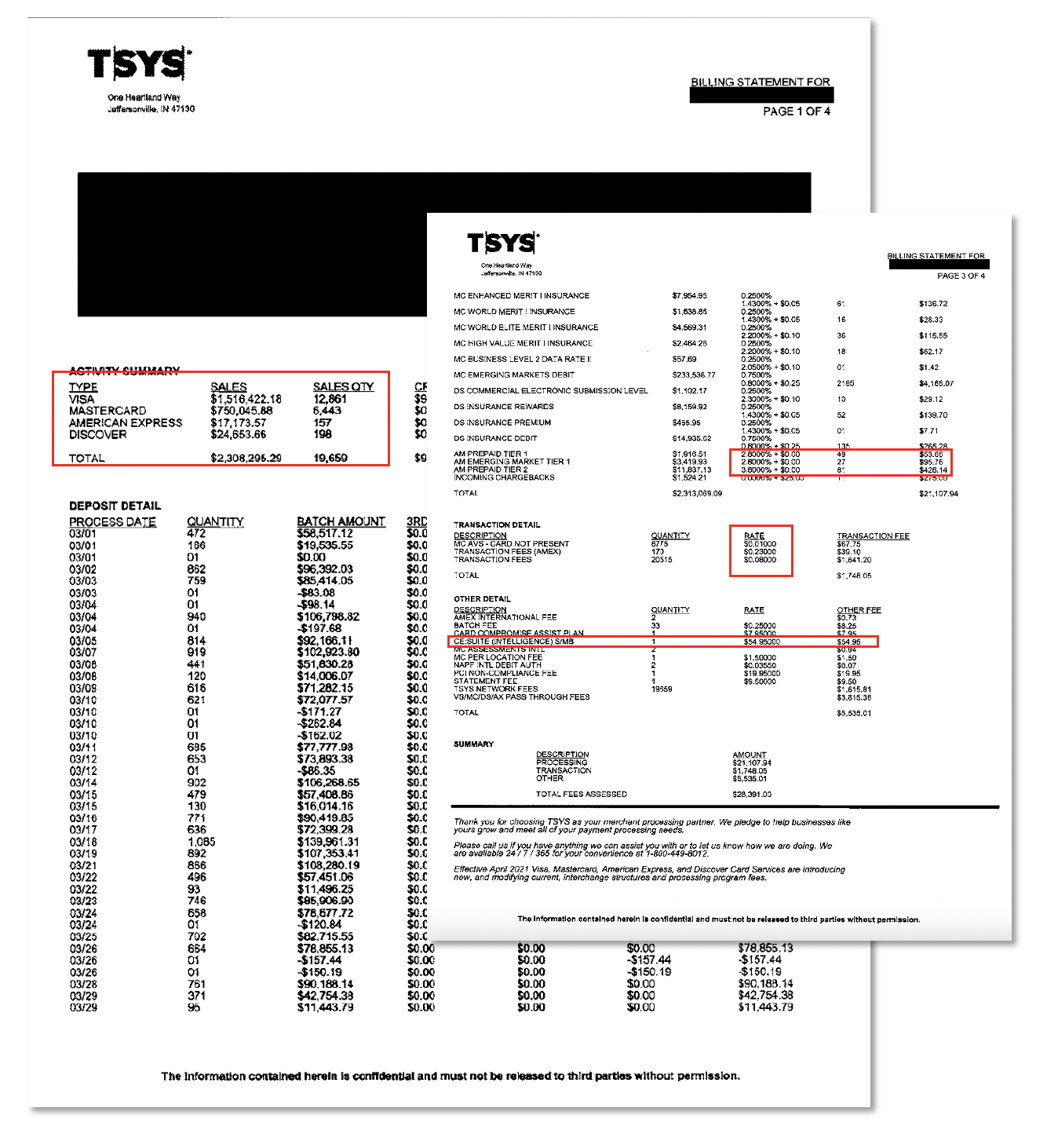

The Numbers Speak for Themselves

Real results from a real customer. Over $6,000/mth in Savings without changing processor, no application, no underwriting, no hardware or software changes, no long term contract required.

The Numbers Speak for Themselves

Real results from a real customer. Over $6,000/mth in Savings without changing processor, no application, no underwriting, no hardware or software changes, no long term contract required.